- info@creditgame.net

- 1-866-935-7066

Here is how you register a fraud alert on your credit report.

TransUnion:

Complete the form (click to download)

(this is required to register a fraud alert on your Canada TransUnion report.)

Equifax:

Call 1-800-465-7166 and press option 2 in order to place an alert.

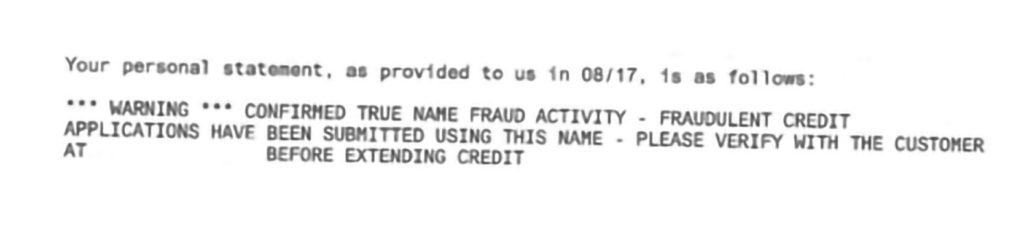

Warning:

In theory this is a great idea but in reality, registering a fraud alert on your credit reports in Canada has some downsides. Some creditors will continue to lend additional credit without calling, even if there is a fraud alert is placed on the report. The good news is that if you ever have to go to court or defend against a fraudulent account you can show that you had an alert on your report and the lender ignored it.

Another problem is that if you are looking to apply for additional financing in Canada, some lenders will automatically decline you if the fraud alert is noticed. I have never heard of a fraud alert causing issues when it comes to major financing like applying for a vehicle loan or for mortgage financing. Fraud alerts only seem to cause problems with credit card applications where the underwriting is done by a computer or is fully automated. Some companies just don’t want the headache or to take the extra time to call someone. They would prefer just to decline you and move on to the next application.

If you change your phone number then you have to remember to update the number with both Equifax and TransUnion. If a potential lender is trying to reach you and they can’t get a hold of you because you have changed your number then you will be declined.

My suggestion – If you have been a victim of fraud or would like to protect your credit reports then you should monitor your credit reports more carefully. You can also sign up directly with the fraud watch programs directly with Equifax and TransUnion.

© 2023 The Credit Game. All Rights Reserved | Designed By Etcetera Projects.